Our Divisions

Newspapers

Newspapers

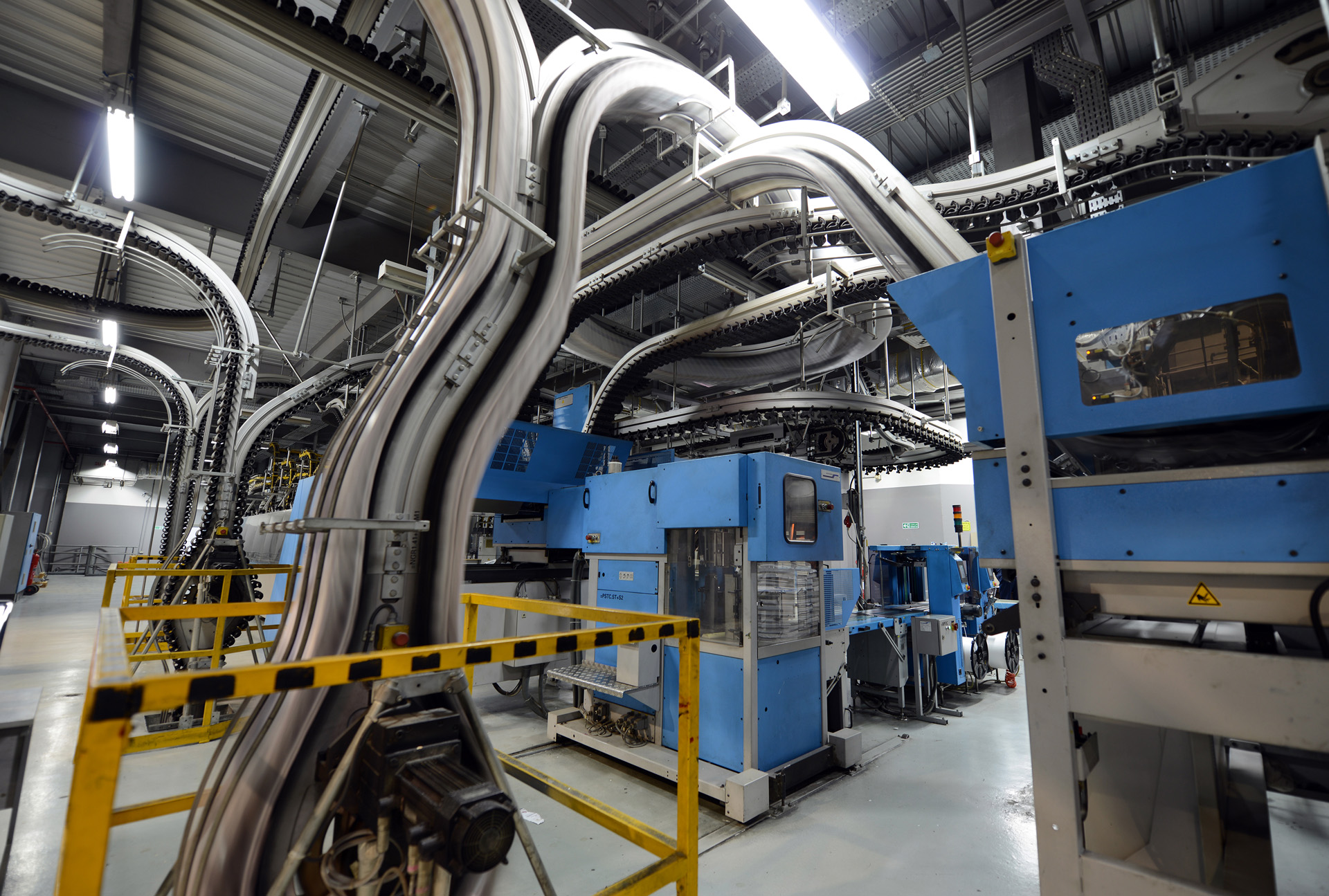

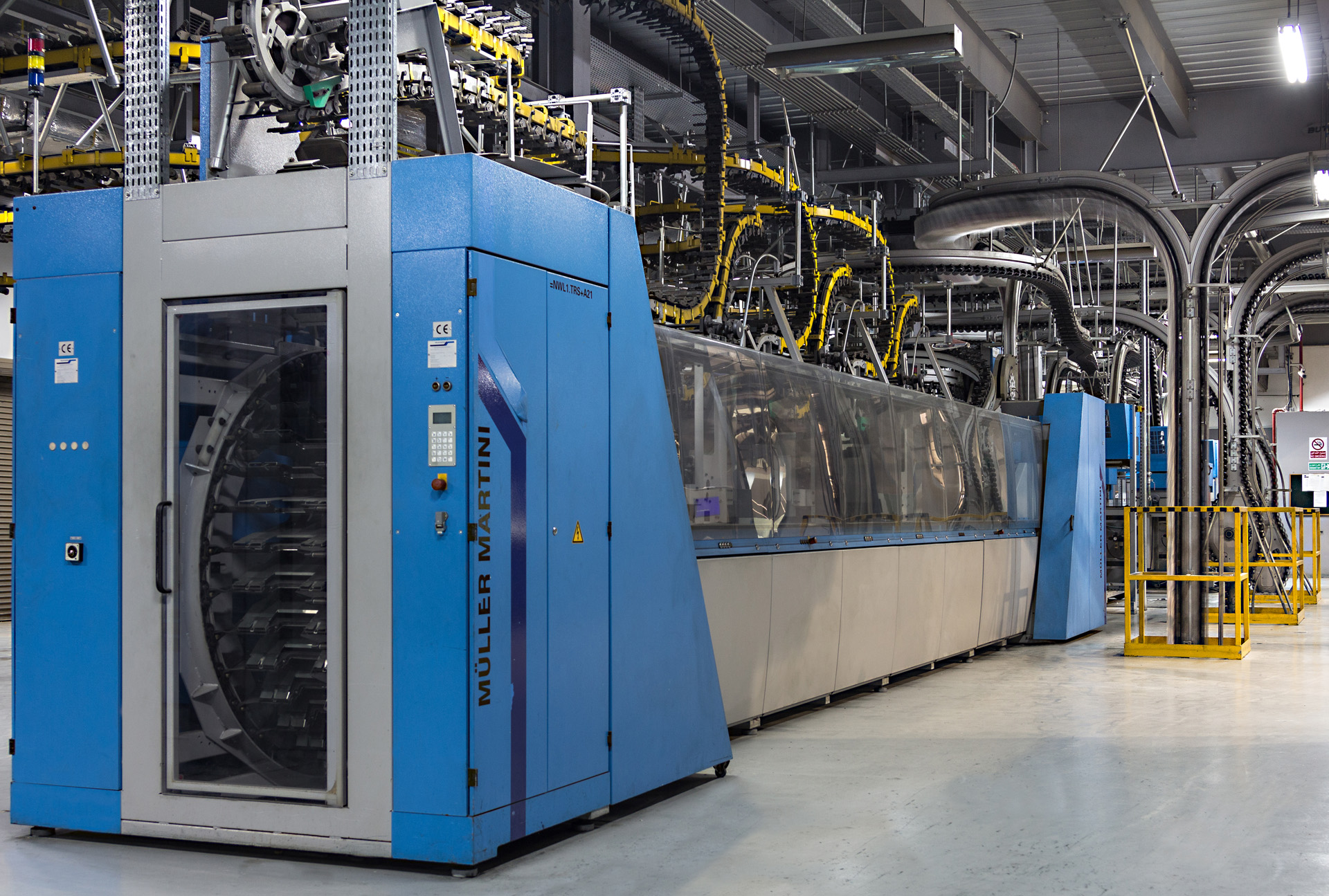

Commercial Printing

Commercial Printing

Digital Printing

Digital Printing

Important Links

{"id":3,"name":"SPPC Main Profile","pages":[{"title":"page 1","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page1.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb1.jpg","htmlContent":""},{"title":"page 2","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page2.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb2.jpg","htmlContent":""},{"title":"page 3","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page3.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb3.jpg","htmlContent":""},{"title":"page 4","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page4.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb4.jpg","htmlContent":""},{"title":"page 5","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page5.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb5.jpg","htmlContent":""},{"title":"page 6","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page6.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb6.jpg","htmlContent":""},{"title":"page 7","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page7.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb7.jpg","htmlContent":""},{"title":"page 8","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page8.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb8.jpg","htmlContent":""},{"title":"page 9","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page9.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb9.jpg","htmlContent":""},{"title":"page 10","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page10.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb10.jpg","htmlContent":""},{"title":"page 11","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page11.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb11.jpg","htmlContent":""},{"title":"page 12","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page12.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb12.jpg","htmlContent":""},{"title":"page 13","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page13.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb13.jpg","htmlContent":""},{"title":"page 14","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page14.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb14.jpg","htmlContent":""},{"title":"page 15","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page15.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb15.jpg","htmlContent":""},{"title":"page 16","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page16.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb16.jpg","htmlContent":""},{"title":"page 17","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page17.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb17.jpg","htmlContent":""},{"title":"page 18","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page18.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb18.jpg","htmlContent":""},{"title":"page 19","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page19.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb19.jpg","htmlContent":""},{"title":"page 20","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page20.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb20.jpg","htmlContent":""},{"title":"page 21","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page21.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb21.jpg","htmlContent":""},{"title":"page 22","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page22.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb22.jpg","htmlContent":""},{"title":"page 23","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page23.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb23.jpg","htmlContent":""},{"title":"page 24","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page24.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb24.jpg","htmlContent":""},{"title":"page 25","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page25.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb25.jpg","htmlContent":""},{"title":"page 26","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page26.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb26.jpg","htmlContent":""},{"title":"page 27","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page27.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb27.jpg","htmlContent":""},{"title":"page 28","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page28.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb28.jpg","htmlContent":""},{"title":"page 29","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page29.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb29.jpg","htmlContent":""},{"title":"page 30","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page30.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb30.jpg","htmlContent":""},{"title":"page 31","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page31.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb31.jpg","htmlContent":""},{"title":"page 32","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page32.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb32.jpg","htmlContent":""},{"title":"page 33","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page33.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb33.jpg","htmlContent":""},{"title":"page 34","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page34.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb34.jpg","htmlContent":""},{"title":"page 35","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page35.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb35.jpg","htmlContent":""},{"title":"page 36","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page36.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb36.jpg","htmlContent":""},{"title":"page 37","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page37.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb37.jpg","htmlContent":""},{"title":"page 38","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page38.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb38.jpg","htmlContent":""},{"title":"page 39","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page39.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb39.jpg","htmlContent":""},{"title":"page 40","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page40.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb40.jpg","htmlContent":""},{"title":"page 41","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page41.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb41.jpg","htmlContent":""},{"title":"page 42","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page42.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb42.jpg","htmlContent":""},{"title":"page 43","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page43.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb43.jpg","htmlContent":""},{"title":"page 44","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page44.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb44.jpg","htmlContent":""},{"title":"page 45","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page45.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb45.jpg","htmlContent":""},{"title":"page 46","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page46.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb46.jpg","htmlContent":""},{"title":"page 47","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page47.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb47.jpg","htmlContent":""},{"title":"page 48","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page48.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb48.jpg","htmlContent":""},{"title":"page 49","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page49.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb49.jpg","htmlContent":""},{"title":"page 50","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page50.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb50.jpg","htmlContent":""},{"title":"page 51","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page51.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb51.jpg","htmlContent":""},{"title":"page 52","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page52.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb52.jpg","htmlContent":""},{"title":"page 53","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page53.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb53.jpg","htmlContent":""},{"title":"page 54","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page54.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb54.jpg","htmlContent":""},{"title":"page 55","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page55.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb55.jpg","htmlContent":""},{"title":"page 56","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page56.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb56.jpg","htmlContent":""},{"title":"page 57","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page57.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb57.jpg","htmlContent":""},{"title":"page 58","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page58.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb58.jpg","htmlContent":""},{"title":"page 59","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page59.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb59.jpg","htmlContent":""},{"title":"page 60","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page60.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb60.jpg","htmlContent":""},{"title":"page 61","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page61.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb61.jpg","htmlContent":""},{"title":"page 62","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page62.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb62.jpg","htmlContent":""},{"title":"page 63","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page63.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb63.jpg","htmlContent":""},{"title":"page 64","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page64.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb64.jpg","htmlContent":""},{"title":"page 65","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page65.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb65.jpg","htmlContent":""},{"title":"page 66","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page66.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb66.jpg","htmlContent":""},{"title":"page 67","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page67.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb67.jpg","htmlContent":""},{"title":"page 68","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page68.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb68.jpg","htmlContent":""},{"title":"page 69","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page69.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb69.jpg","htmlContent":""},{"title":"page 70","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page70.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb70.jpg","htmlContent":""},{"title":"page 71","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page71.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb71.jpg","htmlContent":""},{"title":"page 72","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page72.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb72.jpg","htmlContent":""},{"title":"page 73","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page73.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb73.jpg","htmlContent":""},{"title":"page 74","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page74.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb74.jpg","htmlContent":""},{"title":"page 75","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page75.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb75.jpg","htmlContent":""},{"title":"page 76","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page76.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb76.jpg","htmlContent":""},{"title":"page 77","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page77.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb77.jpg","htmlContent":""},{"title":"page 78","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page78.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb78.jpg","htmlContent":""},{"title":"page 79","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page79.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb79.jpg","htmlContent":""},{"title":"page 80","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page80.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb80.jpg","htmlContent":""},{"title":"page 81","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page81.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb81.jpg","htmlContent":""},{"title":"page 82","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page82.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb82.jpg","htmlContent":""},{"title":"page 83","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page83.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb83.jpg","htmlContent":""},{"title":"page 84","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page84.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb84.jpg","htmlContent":""},{"title":"page 85","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page85.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb85.jpg","htmlContent":""},{"title":"page 86","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page86.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb86.jpg","htmlContent":""},{"title":"page 87","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page87.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb87.jpg","htmlContent":""},{"title":"page 88","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page88.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb88.jpg","htmlContent":""},{"title":"page 89","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page89.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb89.jpg","htmlContent":""},{"title":"page 90","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page90.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb90.jpg","htmlContent":""},{"title":"page 91","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page91.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb91.jpg","htmlContent":""},{"title":"page 92","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page92.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb92.jpg","htmlContent":""},{"title":"page 93","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page93.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb93.jpg","htmlContent":""},{"title":"page 94","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page94.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb94.jpg","htmlContent":""},{"title":"page 95","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page95.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb95.jpg","htmlContent":""},{"title":"page 96","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page96.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb96.jpg","htmlContent":""},{"title":"page 97","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page97.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb97.jpg","htmlContent":""},{"title":"page 98","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page98.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb98.jpg","htmlContent":""},{"title":"page 99","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page99.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb99.jpg","htmlContent":""},{"title":"page 100","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page100.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb100.jpg","htmlContent":""},{"title":"page 101","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page101.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb101.jpg","htmlContent":""},{"title":"page 102","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page102.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb102.jpg","htmlContent":""},{"title":"page 103","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page103.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb103.jpg","htmlContent":""},{"title":"page 104","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page104.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb104.jpg","htmlContent":""},{"title":"page 105","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page105.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb105.jpg","htmlContent":""},{"title":"page 106","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page106.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb106.jpg","htmlContent":""},{"title":"page 107","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page107.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb107.jpg","htmlContent":""},{"title":"page 108","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page108.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb108.jpg","htmlContent":""},{"title":"page 109","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page109.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb109.jpg","htmlContent":""},{"title":"page 110","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page110.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb110.jpg","htmlContent":""},{"title":"page 111","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page111.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb111.jpg","htmlContent":""},{"title":"page 112","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page112.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb112.jpg","htmlContent":""},{"title":"page 113","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page113.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb113.jpg","htmlContent":""},{"title":"page 114","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page114.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb114.jpg","htmlContent":""},{"title":"page 115","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page115.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb115.jpg","htmlContent":""},{"title":"page 116","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page116.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb116.jpg","htmlContent":""},{"title":"page 117","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page117.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb117.jpg","htmlContent":""},{"title":"page 118","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page118.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb118.jpg","htmlContent":""},{"title":"page 119","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page119.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb119.jpg","htmlContent":""},{"title":"page 120","src":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/page120.jpg","thumb":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/real3dflipbook\/flipbook 3\/thumb120.jpg","htmlContent":""}],"date":"2019-04-02 12:53:15","mode":"lightbox","viewMode":"3d","pageMode":"singlePage","pageSize":"full","singlePageMode":"false","skin":"light","sideNavigationButtons":"true","hideMenu":"false","sound":"true","pageFlipDuration":"2","pageShadow1":"true","pageShadow2":"true","pageShadow3":"true","tableOfContentCloseOnClick":"true","thumbnailsOnStart":"false","contentOnStart":"false","rightToLeft":"false","loadAllPages":"true","pageWidth":"1474.016","pageHeight":"1474.016","thumbnailWidth":"100","thumbnailHeight":"100","zoomLevels":"0.95,1.5,3,6","zoomDisabled":"false","startPage":"1","deeplinking":{"enabled":"false","prefix":""},"pdfUrl":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/2019\/04\/sppcGroupProfile_website.pdf","pdfPageScale":"2","pdfPageQuality":"0.9","pdfPageBgColor":"#FFFFFF","singlePageModeIfMobile":"false","pdfBrowserViewerIfMobile":"false","pdfBrowserViewerFullscreen":"true","pdfBrowserViewerFullscreenTarget":"_blank","btnTocIfMobile":"true","btnThumbsIfMobile":"true","btnShareIfMobile":"false","btnDownloadPagesIfMobile":"true","btnDownloadPdfIfMobile":"true","btnSoundIfMobile":"false","btnExpandIfMobile":"true","btnPrintIfMobile":"false","textureSizeIfMobile":"1024","backgroundColor":"#818181","backgroundPattern":"","height":"400","fitToWindow":"false","fitToParent":"false","fitToHeight":"false","offsetTop":"0","responsiveHeight":"true","aspectRatio":"2","lightboxCssClass":"","lightboxContainerCSS":"display:inline-block;padding:10px;","lightboxThumbnailUrl":"http:\/\/www.sppc.com.sa\/wp-content\/uploads\/2018\/10\/prof.png","lightboxThumbnailUrlCSS":"display:block;","lightboxText":"","lightboxTextCSS":"display:block;","lightboxTextPosition":"top","lightBoxOpened":"false","lightBoxFullscreen":"false","lightboxCloseOnClick":"false","currentPage":{"enabled":"true","title":"Current page"},"btnNext":{"enabled":"true","icon":"fa-chevron-right","title":"Next Page"},"btnLast":{"enabled":"false","icon":"fa-step-forward","title":"First Page"},"btnPrev":{"enabled":"true","icon":"fa-chevron-left","title":"Next Page"},"btnFirst":{"enabled":"false","icon":"fa-step-backward","title":"First Page"},"btnZoomIn":{"enabled":"true","icon":"fa-plus","title":"Zoom in"},"btnZoomOut":{"enabled":"true","icon":"fa-minus","title":"Zoom out"},"btnToc":{"enabled":"true","icon":"fa-list-ol","title":"Table of content"},"btnThumbs":{"enabled":"true","icon":"fa-th-large","title":"Pages"},"btnShare":{"enabled":"true","icon":"fa-share-alt","title":"Share"},"btnDownloadPages":{"enabled":"false","url":"","icon":"fa-download","title":"Download pages"},"btnDownloadPdf":{"enabled":"false","url":"","icon":"fa-file","title":"Download pdf","forceDownload":"true"},"btnSound":{"enabled":"true","icon":"fa-volume-up","title":"Sound"},"btnExpand":{"enabled":"true","icon":"fa-expand","iconAlt":"fa-compress","title":"Toggle fullscreen"},"btnExpandLightbox":{"enabled":"true","icon":"fa-expand","iconAlt":"fa-compress","title":"Toggle fullscreen"},"btnPrint":{"enabled":"true","icon":"fa-print","title":"Print"},"webglMinAndroidVersion":"4.4","cameraDistance":"2800","pan":"0","tilt":"0","rotateCameraOnMouseDrag":"true","panMax":"20","panMin":"-20","tiltMax":"0","tiltMin":"-60","rotateCameraOnMouseMove":"false","panMax2":"2","panMin2":"-2","tiltMax2":"0","tiltMin2":"-5","bookX":"0","bookY":"0","bookZ":"0","pageMaterial":"phong","pageHardness":"2","coverHardness":"2","pageSegmentsW":"10","pageSegmentsH":"1","pageShininess":"20","ambLightColor":"#CCCCCC","spotLightColor":"#FFFFFF","spotLightX":"0","spotLightY":"0","spotLightIntensity":"0.1","spotLightShadowDarkness":"0.5","textureSize":"2048","google_plus":{"enabled":"true","url":""},"twitter":{"enabled":"true","url":"","description":""},"facebook":{"enabled":"true","url":"","description":"","title":"","image":"","caption":""},"pinterest":{"enabled":"true","url":"","image":"","description":""},"email":{"enabled":"true","url":"","description":""},"submit":"Save Changes","rootFolder":"https:\/\/sppc.com.sa\/wp-content\/plugins\/real3d-flipbook\/"}

Latest News

Announces Calling Candidature for Board Members Elections

| Element List | Explanation |

|---|---|

| Introduction | SPPC announces the opening of nomination for membership of the Board of Directors for the next session starting from 07-05-2024 to 06-05-2027 for a period of three years.Those who willing to nominate themselves for the board of directors’ membership who meet the conditions and qualifications for membership, must submit their candidacy applications within the period specified in the announcement and in accordance with the details contained in this announcement.The nomination for the Board of Directors membership will be in accordance with the provisions of the Companies Law issued by the Ministry of Commerce, the Corporate Governance Regulations issued by the Capital Market Authority, and the policy, standards and procedures of the Board of Directors’ membership approved the General Assembly of SPPC. Candidates will be elected at the next General Assembly meeting, which will be announced later after obtaining the necessary approvals from the competent authorities. |

| Type of Assembly | New Session |

| Assembly Start Date | 2024-05-07 Corresponding to 1445-10-28 |

| Assembly End Date | 2027-05-06 Corresponding to 1448-11-29 |

| Number of members | 9 |

| Application Start Date | 2024-01-15 Corresponding to 1445-07-03 |

| Application End Date | 2024-02-15 Corresponding to 1445-08-05 |

| Applications Submission Method | The original applications of candidacy must be submitted to the attention of Nomination and Remunerations Committee before the end of nomination period specified in the announcement, by submitting it during the official working hours of the Company (from 08:00 am to 04:00 pm) by one of the following ways:1-SPPC, Riyadh, King Fahd Street, Alnakheel tower, 7th floor. P.O. Box 50202 Riyadh 11523.2-E-mail: mohammed.alanazi@sppc.com.saFor inquiries, please contact the investors relations at the following numbers:+966 112032022 ext.: 138E-mail: mohammed.alanazi@sppc.com.sa |

| Policy and criteria of nomination | The candidate needs to fulfill the conditions for nomination for the Board of Directors membership in accordance with the relevant laws and regulations and as follows:1- Fulfill of Board of Directors membership’s general conditions and the nomination requirements contained in the policy, standards and procedures of the Board of Directors’ membership approved by the General Assembly of the Company (attached)2- Submit during the period specified in the announcement a signed letter (as per the attached form) signed by the candidate declaring his\her desire to be nominated for the board of directors’ membership (attached), accompanied by all the necessary requirements.3- Submit Form No. (1) CV (attached).4- Submit signed copy of Form No. (3) Issued by the CMA for Board membership nomination (attached), and which can be found on the CMA’s website (http://cma.org.sa).5- Submit a statement containing details of the number and dates of his/her memberships on the boards of directors of joint stock companies and the committees that he\she have assumed or still a member of.6- Submit a statement in which the candidate discloses any direct or indirect interest in the business and contracts executed for the company.7- Submit a statement containing details of companies or institutions that the candidate participates in managing or owning, and which conduct similar business to the Company.8- Attach A clear copy of the national ID (residency or passport for non-Saudis), including the candidate’s contact numbers.9- If the candidate has previously held the membership of the SPPC Board of Directors, he must attach to the candidacy application a statement from the company’s management about the last session in which he was a member of the Board, including the following information:• The number of board meetings that took place during each of the years of the session, the number of meetings attended by the member on his own behalf, and his attendance rate for the total meetings.• The permanent committees in which the member participated in, the number of meetings held by each of those committees during each year of the session, the number of meetings he attended, and the percentage of his attendance to the total meetings.10- All forms shall be filled out in Arabic and English.The Remuneration and Nominations Committee will study the applications of the candidates received, noting that voting in the General Assembly of the new session of the Board will be limited to candidates who meet the conditions, controls and standards set forth in this announcement, noting that cumulative voting will be used to elect members of the Board of Directors. |

| Attachment of the CMA approved resume for the nominees for board memberships in the joint-stock companies listed on the Saudi Exchange | Resume |

| Attached Documents | 1 2 3 |